Top 10 Best AfterShip Alternatives & Competitors for 2026: What Works Best for eCommerce

What we’ll cover

A Practical Guide for eCommerce and Operations Teams

AfterShip is a popular choice for eCommerce and Shopify-native brands, particularly for shipment tracking, branded tracking pages, and returns workflows. But “popular” isn’t always synonymous to “best fit” when it comes to software compatibility.

As order volume grows, small differences start to matter. In the case of AfterShip, it’s tracking freshness, webhook reliability, plan gated branding, and rate limits during backfills, to name a few.

In this guide built for eCommerce operators and CX leaders, we break down 10 of the top AfterShip competitors. So, whether you’re auditing your current AfterShip setup or deciding to adopt a similar high-performance alternative, you’ll find a tool that aligns with your specific operational reality.

What AfterShip Does Well?

AfterShip’s use-cases emerge most strongly when you need reliable tracking data with a UX layer that’s built to impress customers. Its core competencies include:

-

Standardizing carrier scans into uniform shipment statuses.

-

Webhook-driven tracking updates for real-time order visibility.

-

Branded tracking pages with strong design controls.

-

Returns portal with automation rules and an admin view.

-

Developer flexibility for store tracking data via API and webhooks.

AfterShip is a strong choice for brands looking to drive loyalty via real-time tracking updates. Because it offers a low barrier to entry through tiered pricing, it has become a go-to solution for startups looking to scale quickly without heavy upfront costs.

Why Brands Start Exploring AfterShip Alternatives?

AfterShip works well for visibility and post-purchase CX at lower order volumes. But teams often switch as shipping grows into higher-volumes incurring higher costs.

Common reasons for substitution includes:

-

Per-shipment charges and add-on fees as volume grows.

-

Data latency as carrier scans lag behind official carrier sites.

-

Templated tracking pages without an embedded experience.

-

Brand ownership is dependent on the subscription plan.

-

Rate limits, retries, backfills, and webhook versioning.

This is especially common for:

-

Fashion and footwear (high returns and exchange complexity)

-

Beauty and wellness (CX sensitivity and trust signals)

-

Cross-border brands (carrier variance and reverse logistics cost)

AfterShip Alternatives for Post Purchase Experience in 2026

|

Alternatives |

Tracking |

Returns |

Carrier Depth |

Analytics |

Implementation |

Best region |

|

AI-crafted branded tracking plus proactive alerts |

Ops-led returns workflows |

600+ carrier integrations |

Carrier performance+returns+engagement |

Assisted onboarding |

Global brands shipping at scale, India, MEA |

|

|

Enterprise tracking and notifications |

Policy-led returns and exchanges |

Strong enterprise carrier ecosystem |

Retail-focused post-purchase insights |

Heavier integration |

US, enterprise retail |

|

|

Orchestrated comms across shipment states |

Exchange and store credit nudges |

Enterprise carrier support |

CX and ops reporting |

Enterprise setup |

EU strong, global capable |

|

|

Multi-carrier tracking with normalized events |

Returns routing and PUDO support |

Broad multi-region coverage |

Logistics performance dashboards |

Platform rollout |

APAC strong, global |

|

|

Polished portal and exchange-first flow |

Instant exchanges and store credit |

Depends on carrier setup |

Returns program reporting |

Fast for Shopify |

US, Shopify heavy |

|

|

Tracking plus branded updates |

Portal with QR and service points |

API connects to 160+ carriers |

Shipping workflow reporting |

API-first, can be technical |

Europe |

|

|

Tracking via API and webhooks |

Not a full returns suite |

Multi-carrier via unified API |

Shipping and event logs |

Engineering-led setup |

US, platform builders |

|

|

Not core product |

Cross border returns focus |

1,500+ carrier services |

Returns reporting hub |

Assisted integration |

UK, EU, cross-border |

|

|

Tracking is secondary |

Customizable portal and rules |

Varies by integrations |

Returns automation metrics |

Shopify-led setup |

US, Shopify heavy |

|

|

Tracking not core |

Portal plus coverage model |

Shopify led |

Returns reporting |

Shopify-led setup |

US, Shopify heavy |

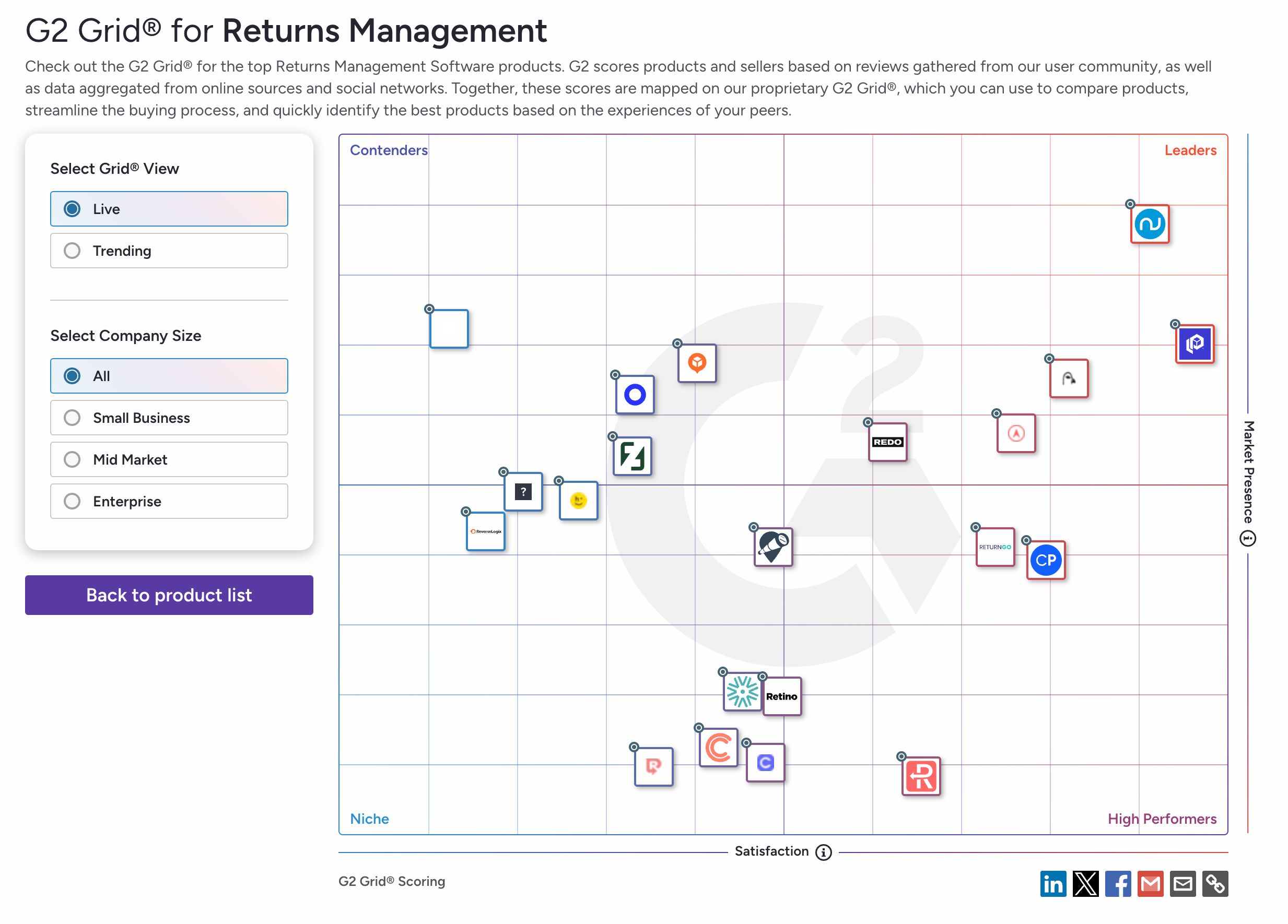

Methodology: How ClickPost Evaluated AfterShip Alternatives?

This comparison is based on publicly available information as of January 2026.

Sources used include:

-

Vendor documentation and pricing pages.

-

Developer docs and integration notes.

-

Verified third-party reviews, primarily G2 rating.

Each platform was assessed based on:

-

Tracking features like branding and status accuracy.

-

Returns portal UX, exchange and credit options, policy rules.

-

Carrier coverage and connection model

-

Actionable insights on exceptions, SLA risk, and carrier performance.

-

Go-live effort based on integration type and setup complexity.

-

Region where the product performs best and has strongest coverage.

Each software was evaluated on criteria used by e-commerce operations teams when they evaluate tracking and returns tools. (Ratings and product claims can change.)

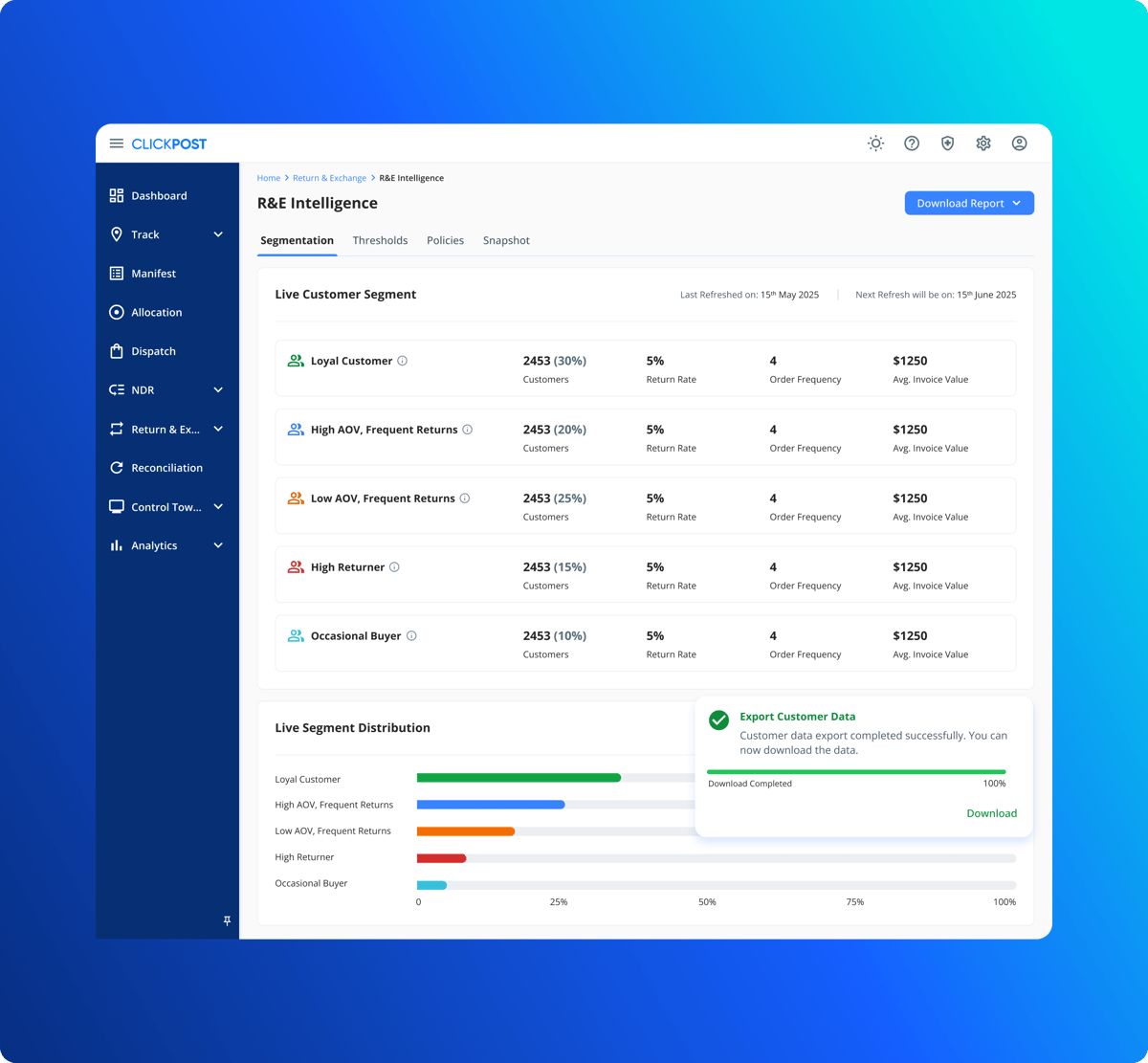

1. ClickPost

ClickPost is built for brands where shipping performance directly shapes revenue, retention, and support load. It is used most by logistics and operations teams managing multi-carrier networks, by CX leaders who need fewer WISMO tickets and faster exception resolution, and by retention teams who want tracking and returns to drive repeat purchases.

The platform connects carrier performance, EDD accuracy, exception signals, origin-to-destination visibility, and returns behaviour into one control view. That lets teams intervene early, standardize outcomes across partners and regions, and run post-purchase journeys that feel personalized without becoming operationally fragile.

Key capabilities

-

AI-assisted tracking page creation with upsell modules.

-

Exchange-first nudges, store-credit retention, and policy guardrails.

-

Returns personas to segment customers and tailor eligibility and outcomes.

-

Hyper-personalised email and notifications based on shipment events.

-

AI-led EDD with custom models for EDD ranges and prediction.

-

Performance-based carrier allocation with configurable rules and simulation.

-

Control-tower analytics spanning exceptions and warehouse delays.

Implementation

-

Typical go-live in days to weeks.

-

Built to expand across carriers and regions.

Best for: Brands where post-purchase performance and delivery controls affect revenue, retention, and support workloads. Teams that need an upgrade to their tracking and returns capabilities to ensure better brand recall and recognition.

Testimonial:

“With ClickPost’s real-time tracking, customers receive timely updates, significantly reducing WISMO queries and helping us improve our post-purchase experience.” — BY Oriflame

Ready to upgrade how your tracking runs and how customers experience it? Book a demo and see the platform in action.

2. Narvar

Narvar is built for omni-channel retail complexity, combining predictive post-purchase intelligence with real-world returns reach. Its IRIS AI learns from 74B+ interactions annually to predict delivery exceptions and reduce return fraud. It’s commonly used by enterprise retailers who run post-purchase at scale across tracking, notifications, and returns, with fewer manual escalations.

Strengths

-

Unified post-purchase messaging across channels with strong brand control.

-

Reduces return fraud with risk-aware return approvals and outcomes.

-

Built for structured data ingestion and enterprise-grade deployments.

Limitations

-

Integration is heavy if you require deep, custom API flexibility.

-

Pricing is quote-based, so budget forecasting can be harder upfront.

-

Less suited for teams that need fast self-serve changes and quick go-lives.

Best for: Enterprise omnichannel brands requiring standardized post-purchase workflows and data-driven returns optimization.

3. ParcelLab

parcelLab is an enterprise post-purchase experience platform that treats tracking and notifications as brand touch-points. It helps CX and marketing teams control brand messaging, language localization, and transactional communication that optimizes engagement. The goal is to enable brands in providing consistent post-purchase updates that are embedded into your website’s domain.

Strengths

-

Strong on-domain tracking and notification customization.

-

Multi-language support for consistent global customer communication.

-

Enterprise-ready UI built for CX and marketing teams.

Limitations

-

High internal resource demand to build and maintain custom-coded UI.

-

Lean more towards communications, not deep operational intelligence.

-

Enterprise setup can require more data mapping and governance

Best for: Global brands that want post-purchase CX consistency across regions and languages.

4. Parcel Perform

Parcel Perform is a delivery experience and shipment intelligence platform built around carrier data quality. It connects to 1,100+ carriers and maps events into 155+ standardized event types. Teams who benefit most from Parcel Perform are those seeking data purity and AI visibility. It tracks trust signals like delivery reliability and first attempt success proving ways to measure and improve performance.

Strengths

-

Normalises carrier events at scale across 1,100+ carriers.

-

Ops-focused analytics for delays, exceptions, and carrier performance.

-

AI-driven logistics visibility for supply chain auditing.

Limitations

-

The user interface is built for logistics analysts.

-

Front-end customization for tracking pages isn't intuitive, lacking drag and drop features.

-

Implementation requires significant data mapping to work efficiently.

Best for: Marketplaces and global brands that need cross-carrier performance control.

5. Loop Returns

Loop is a Shopify-first returns platform built to retain revenue through exchange-first flows, store credit, and fast resolutions. It is commonly used by DTC brands in high-return categories like apparel. Loop also acquired Wonderment to add proactive order tracking capabilities alongside returns operations.

Strengths

-

Bonus credit and ‘Shop Now’ features increase exchange adoptions.

-

Instant exchange-style flows that reduce wait time for replacements.

-

Non-technical CX managers can set complex return rules without coding.

Limitations

-

Limited utility for custom-built stacks other than Shopify.

-

Tracking remains a secondary feature with less maturity than competitors.

-

Not ideal for brands with cross-border, complex returns.

Best for: Shopify DTC brands that want to convert returns into exchanges and retain revenue.

6. Sendcloud

Sendcloud is a Europe-first shipping platform that centralizes label creation, multi-carrier automation, branded tracking, and a self-serve returns portal. It is built for teams that want one operational hub for shipping rules, service points, and paperless returns across a wide carrier network aligned to Europe’s logistics reality.

Strengths

-

Native integrations with 100+ European carriers and 390k+ service points.

-

Dynamic delivery options (like same-day or pickup points) at checkout.

-

Pick-and-pack: one-click label and packing slip printing.

Limitations

-

Carrier depth is lacking for North American and APAC-based brands.

-

Advanced automation and branding depth is reliant on plan level.

-

Costs scale with label volume; unexpected financial spikes at peak demand season.

Best for: EU-heavy brands that need shipping ops, rules, and returns under one roof.

7. EasyPost

EasyPost is shipping infrastructure for engineering-led teams. It provides a unified API for rates, labels, tracking events, address verification, and carrier account management. It is commonly used by brands that want to instantly compare carrier rates using a smart API and select the cheapest or fastest option based on custom logic. It often works as a backend function in custom platforms.

Strengths:

-

API-first simplicity to integrate over 100 carriers in any custom application.

-

Event-driven tracking via webhooks supports real-time operational workflows.

-

Carrier-agnostic rate shopping with custom logic.

Limitations:

-

No customer-facing UI or post-purchase CX suite.

-

Requires solid engineering hygiene for retries, backfills, and rate limits.

-

Support is developer-centric and mainly covers API troubleshooting.

Best for: Marketplaces, 3PLs, and product teams that want API-first shipping control.

8. ZigZag Global

ZigZag Global is built for cross-border returns at scale. It combines a localized returns portal with a large carrier and drop-off network across 170+ countries to physically move the products across borders and reduce waste. The differentiator for ZigZag Global is its ‘Peer-to-Peer’ and local hub network that enables reselling of returned products at the local markets.

Strengths

-

Paper-less return solution with 1500+ carrier integrations.

-

Returns portal supports multi-market experiences and policy options.

-

Designed to reduce cross-border friction through local return routes

Limitations

-

Significant integration overhead connecting to physical warehouses.

-

Portal customization can feel constrained for premium brand teams

-

Returns-first in scope; tracking and communications still need other tools.

Best for: UK and EU brands who pledge circular efficiency.

9. ReturnGO

ReturnGO is another Shopify-centric returns and exchanges platform focused on policy control and automation. It stands out for “instant credit” style resolutions like Ship It Later and Keep the Item. It is used by brands wanting to reduce reverse-logistics cost while steering shoppers toward store credit, exchanges, and faster return resolutions.

Strengths

-

Native AI that calculates the most profitable outcome for a return.

-

Integrations with niche 3PLs, ERPs, helpdesks with its open API.

-

One-step label and packing slip print at packing.

Limitations

-

Setup can be overwhelming due to sheer number of logic.

-

Doesn’t feature high-end, bespoke visual design for UX.

-

Performance/load times on the portal can occasionally be slower.

Best for: Shopify brands that want granular control over return outcomes and automation.

10. Redo

Redo pairs a branded returns portal with an opt-in “return coverage” add-on at checkout. That model gives brands a commercial lever to offer free return labels selectively, while nudging exchanges or store credit. It is designed for Shopify brands that want policy control without a heavy ops buildout.

Strengths

-

Shifts return risk from merchants to customers with return coverage.

-

Initiate exchange in seconds and UX optimized for mobile users.

-

Shopify-native actions for exchanges, credit, and refunds workflows.

Limitations

-

Runs conversion risk owing to the protection fee at checkout.

-

Currently very US-market focused; limited support for international carriers.

-

Feature depth may be narrower for enterprises.

Best for: Shopify brands that want a returns portal plus paid coverage economics.

Read complete discussion from reddit community

![]()

Migration Checklist: Switching from AfterShip Smoothly

Before Switching

-

Export all historical shipment metadata like order IDs, reason codes, etc.

-

Audit your current tracking URLs across email, SMS, website footer.

-

Map your automated notification flows that are currently active.

-

Gather your carrier API credentials and login keys for every carrier.

-

Set a WISMO baseline to measure support tickets for the new tool.

During Migration

-

Configure your custom tracking domain and move DNS settings early on.

-

Recreate your brand’s visual identity in the new tracking portal.

-

Connect your carrier accounts; run test shipments to ensure data is flowing.

-

Test webhooks in staging while keeping AfterShip live to validate event parity.

-

Draft and test new email templates by sending internal test notifications.

After Go-Live: For Optimization

-

Verify that carrier updates are appearing without significant latency.

-

Check for broken redirect links.

-

Analyze the first 100 tickets for tracking-interface issues or confusion.

-

Disable the AfterShip API keys to protect data.

-

Check billing against shipment volume, returns volume and overages.

Frequently Asked Questions (FAQs)

1. What are the best alternatives to AfterShip for post-purchase tracking in 2025–2026?

The best AfterShip alternatives offer deeper delivery intelligence, personalized customer communication, and end-to-end visibility, from warehouse operations to in-transit exceptions. Leading AfterShip alternatives in this regard include ClickPost for real-time SLA monitoring and exception reporting, Narvar for proactive order updates, parcelLab for personalized tracking, and Parcel Perform for carrier performance insights.

2. Is AfterShip actually the best post-purchase tracking software, or is it overhyped?

AfterShip works well for scaling SMBs that need automated tracking across many carriers. Its strengths are branded tracking pages, upsell nudges, and clear status notifications. But it stops short for enterprise use cases. You won’t get warehouse-level visibility, diagnostic tools for stalled shipments, or in-depth delivery exception reporting yet.

3. Which AfterShip alternative offers cheaper pricing with similar shipment notifications?

AfterShip can feel inexpensive at low volumes, but pricing becomes less predictable as shipments approach 25,000 and move to custom quotes. At that scale, merchants often evaluate alternatives with similar notification depth and compare quotes directly. There’s no single cheapest option. Depending on volume, communication channels, and notification complexity, alternative quotes often land at par with or better than AfterShip.

4. How does AfterShip compare with ParcelLab for ecommerce shipping and customer experience?

AfterShip focuses on tracking aggregation, notifications, and faster setup. parcelLab leans more into customer experience, offering deeper control over messaging, content, and branded journey orchestration. AfterShip is easier to deploy, while parcelLab suits brands that prioritize CX customization at scale.

5. Which parcel tracking platform beats AfterShip for SMS and email delivery updates?

Platforms like ClickPost, Narvar, and Parcel Perform outperform AfterShip when notifications need to be contextual. They support carrier-aware triggers, delay prediction, localized messaging, and conditional logic. AfterShip’s updates are reliable, but largely status-driven rather than workflow-led.

6. What’s the most reliable tracking tool like AfterShip for ecommerce businesses doing a few hundred orders a month?

At lower volumes, AfterShip is often sufficient. Many enterprise-grade alternatives are built for higher-order complexity, not early-stage stores. For a few hundred orders a month, reliability comes down to clean tracking pages, stable carrier syncs, and simple integrations rather than advanced analytics. If you’re at this stage, prioritize ease of use over feature depth, even though the best-fit tools aren't on this list yet.

7. Which platform offers better branded tracking pages than AfterShip?

Post-purchase management solutions like ClickPost and Narvar offer deeper control over branded tracking pages than AfterShip. This includes custom domains, flexible layouts, faster load times, and dynamic content blocks. While AfterShip supports basic branding, these platforms allow closer alignment with a store’s visual identity and reduce delivery anxiety through clearer EDDs and milestone-based updates.

8. Is AfterShip legit and safe to use for ecommerce tracking?

Yes, AfterShip is a legitimate and widely used tracking platform. That said, merchants should still review data security practices, compliance documentation, access controls, and API permissions before integrating any post-purchase tool. Larger or regulated businesses typically require clearer governance and security disclosures before deploying such platforms at scale.

9. How does AfterShip perform as a multi-carrier shipping and tracking solution?

AfterShip supports a wide range of carriers, but coverage alone doesn’t equal carrier intelligence. Many alternatives offer additional capabilities, including SLA tracking, carrier performance benchmarking, exception categorization, and proactive issue detection. Brands managing multiple regional or international carriers often need more than simple status normalization.

10. Which AfterShip alternative is best for Shopify stores looking to scale?

As Shopify stores scale, they often outgrow plug-and-play tracking tools. Strong AfterShip alternatives for this stage support higher API limits, automation rules, advanced reporting, and complex carrier setups. Platforms such as ClickPost, Parcel Perform, and EasyPost are typically evaluated when operational control and visibility become more important than quick setup.

11. Is Parcel Perform or AfterShip better for real-time parcel tracking?

Parcel Perform is stronger on analytics, carrier performance benchmarking, and delivery trend analysis. AfterShip focuses more on customer-facing tracking and standardizing tracking statuses. If you need insight into delays and root causes, Parcel Perform is a better fit. If frontend tracking is the priority, AfterShip is usually sufficient.

12. Which shipping platforms offer real-time delivery updates across multiple carriers?

Real-time delivery tracking depends on API freshness, webhook reliability, and the quality of carrier data normalization. Platforms like ClickPost, Parcel Perform, and EasyPost are often chosen for this as they invest heavily in carrier integrations and event processing to flag shipping delays, failed attempts, and delivery exceptions faster across regions.

13. Which AfterShip alternative is best for customer experience and delivery assurance?

If delivery assurance is the priority, AfterShip’s status-led tracking can feel limiting. Brands usually look for tools that support proactive alerts, SLA monitoring, and structured exception handling alongside clear customer communication. ClickPost is often considered in this context, as it helps reduce WISMO queries and maintain trust during delays or delivery failures.

14. I just want simple package tracking software that sends automatic updates — what’s better than AfterShip?

If you want a simple package tracking software without feature overload, look for solutions that offer automated branded tracking, on-time milestone-based updates, and transparent pricing. These basics improve the post-purchase experience without heavy customization. You can consider options such as EasyPost and Sendcloud for this use case.

15. What should I look for before replacing AfterShip with another post-purchase platform?

Before replacing AfterShip, focus on whether the platform fits your operations. Look at carrier data accuracy, migration effort, notification flexibility, reporting depth, and how pricing scales over time.

✔️ Technical Review by - Kammaljit Deka - Product Manager at ClickPost (Last Fact-Checked: February 2026)

.png?width=879&height=549&name=Page%2074%20(1).png)