Beauty Industry Ecommerce Market: Trends, Growth & Insights (2026)

20 Nov, 2025

|

9 Min Read

Read Blog

Table of Contents

TL/DR summary

A practical, bias‑free read on what shoppers in the US actually buy: routine beauty staples in skin care and hair care, comfort‑first makeup, and momentum in fragrance and body that drives baskets and purchase frequency.

Key pointers

Habit goods (cleanser, serum, moisturizer, SPF lotion, lip balm) anchor repeat purchase and steady sales.

Hybrid color (skin‑loving tinted moisturizer, cream blush, precise lip liner) wins because it is easy and photogenic.

Scalp and hair repair treatments, plus a protective spray, fuel healthy‑hair narratives.

Fragrance growth splits: concentrated juices and minis build purchase confidence before a full bottle.

Access and inclusion matter: fragrance-free options, broader shades for dark/light tones, textures that suit sensitive skin.

If you align assortments to these durable behaviors (treatment first, comfort textures, inclusive tones, discovery before commitment), you will convert curiosity into repeat purchase, gather data you can act on, and keep momentum through launches and lulls alike. That is how brands translate “Top” into everyday success.

| Category | Why It Sells | Example Formats | What to Watch | Who’s Buying | Top Ingredients | Viral Triggers | Price Sweet Spot |

Brands Winning

|

| Skin care | Daily habit + visible results | Hydrating serum, SPF, moisturizer | Barrier repair, sensitive skin | Gen Z + Millennials | Ceramides, niacinamide, peptides | Skin cycling, slugging | $12–$40 |

CeraVe, Glow Recipe

|

| Makeup | Instant enhancement | Tinted moisturizer, concealer, mascara | Hybrid formulas, inclusive shades | Gen Z + Millennials | Vitamin C tint, caffeine | Clean girl look | $10–$35 | Rare Beauty, Elf |

| Hair care | Health + style | Scalp serum, bond mask, heat spray | Gloss hair, heat-safe styling | Millennials + Gen X | Bond-repair tech, rosemary oil | Glass hair trend | $15–$60 | Olaplex, OUAI |

| Fragrance | Identity + gifting | Mini sets, EDP | Signature scents, layering | Gen Z + High-income | Iso E super, ambroxan | Scent layering | $30–$150 |

Sol de Janeiro, Dior

|

| Body | Comfort + barrier | Ceramide creams, exfoliating sprays | Hydrating textures | Sensitive skin audience | Lactic acid, urea | Glass body, strawberry legs | $8–$30 |

Necessaire, Sol de Janeiro

|

Beauty is now a data business. When categories rise or slow, it moves inventory, media, and margin. That is why brands and retailers closely monitor the top beauty products conversation. In a market where skin care and hair care are daily habits and makeup trends can pivot on a single video, understanding where demand concentrates helps businesses plan launches, allocate shelf space, and forecast sales.

In the US, demand skews toward practical staples (cleansers, lip balm, moisturizer) and confidence drivers (acne care, mascara, concealer), with a premium layer of fragrance and targeted serum formulas.

Our goal here is simple: translate known market signals into a bias‑free, stats‑aware view of what consumers actually buy and why that matters for operations, marketing, and the P&L. From favorite beauty products in the US market to the best makeup products, we access the data that helps businesses.

Skin is a daily ritual; habit goods anchor retention. Consumers reward efficacy and comfort.

Skin care staples: facial cleansers, moisturizer, SPF lotion, and hydrating serum. These beauty products win because they fit routines and deliver visible outcomes (clarity, fewer breakouts, smoother texture)

Treatment engines: targeted acne care (benzoyl/peroxide/retinoids), pore‑refining tonics, and barrier‑friendly hydrators. A milky toner format has surged because it soothes sensitive skin while layering under actives.

Texture & tone: consumers look for soft, sheer finishes that play well under cosmetics; pores and redness control are frequent claims.

What to stock: daily moisturizers (including fragrance-free), a reliable serum trio (hyaluronic, vitamin C, retinol), and broad‑spectrum SPF lotion for sun care.

Hydrating serum (HA + glycerin) for all skin types; barrier‑repair creams for sensitive skin.

Everyday lip balm (with SPF) that leaves just the right amount of shine.

Lightweight tinted moisturizer for weekday wear; easy shade matching with light to dark shades.

Consumers want speed, comfort, and “looks like me” results—plus camera confidence.

The edit: comfort‑wear concealer (crease‑resistant), skin‑evening tinted moisturizer, lift‑and‑define mascara, and modern blush (liquid or cream) that gives warm, sheer color.

Lips lead stories: balmy stains and precise lip liner help lock in a perfect shade without dryness; nourishing lip care blends skincare + tint.

Creator cues: a pro makeup artist routine is now everyday content; formats that photograph well (soft focus, flexible formula) earn compliments.

Shade inclusion: flexible shade mapping for both dark and light skin tones keeps conversion rates high.

Lengthening mascara that holds curl without flakes; satin‑matte blush sticks for a fresh flush; comfort concealer that is easy for wearing all day.

Consumers read hair like skin, and they shop treatments first, then style.

Daily core: strengthening shampoos/conditioners, bond repair masks, scalp serum for buildup/balance.

Styling is back: heat-protectant sprays, frizz-control creams, and gloss drops that add shine without weight.

Formats that win: lightweight leave‑ins, overnight masks, quick‑rinse treatments that preserve the color and life of hair.

Fragrance shapes identity; body care sustains routines and basket size.

Fragrance dynamics: elevated concentrations (perfume strength), travel minis, and value sets. People trial a scent family before a full bottle.

Body care: barrier‑rich creams, exfoliating mist/sprays, and ceramide lotion. Calming claims help sensitive skin; hydrating textures keep body comfort high.

Retail tactics: discovery samplers increase purchase confidence; replenishment reminders drive repeat purchase cycles.

“Top‑selling” clusters, not one hero: cleansers, lip balm, SPF lotion; lip color hybrids; lengthening mascara; scalp‑first hair care; and prestige perfume with mini sizes.

“Top‑demanded” features: gentle for sensitive skin, inclusive shades, long‑wear yet sheer comfort, fragrance-free options, and easy‑to‑layer formula.

“Top‑searched” moments: seasonal SPF, back‑to‑school acne, holiday fragrance sets, and new launch bundles (sometimes celebrity‑led—e.g., Victoria Beckham beauty drops often spark a fast collection response).

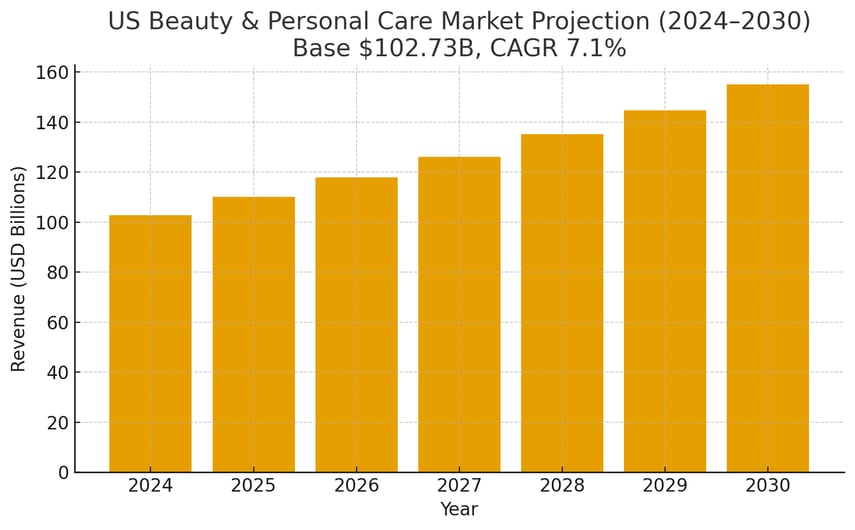

US Beauty & Personal Care projection provides planning context for your category bets. Use it to pace inventory for skin, hair, makeup, fragrance, and body through 2030. (See the chart below.)

Hydrating serum; barrier cream moisturizers; broad‑spectrum SPF lotion.

Gentle cleanser; milky toner for sensitive skin; targeted acne gel.

Weekday base: tinted moisturizer that layers under makeup.

Flexible concealer; cream blush; defining mascara; precision lip liner + nourishing tint for lips.

Bond mask + scalp serum; heat spray; frizz‑taming cream for soft hair shine.

Discovery perfume sets (trial before a full bottle); ceramide body creams; exfoliating body mist/spray for smoother skin and body tone.

Elevate the best beauty products with clear claims (barrier support, “for sensitive skin”).

Use mini and full-size ladders; promote one-bottle multi‑use options where genuine (face + body oil).

Keep refills visible; educate on squeezing the last drop with airless pumps.

In a crowded aisle, the winners are not the loudest; they are the products that fit real lives. Think of the weekday routine that needs a sheer base and a soft finish; the commuter who wants a pocket lip balm and a travel perfume bottle; the creator who needs a crease‑smart concealer and a lengthening mascara; the parent who prefers fragrance free moisturizers for sensitive skin; the enthusiast who will browse minis, test a scent, and then commit to a full size.

Whether it is a celebrity capsule (Victoria Beckham included) or a pharmacy staple, the playbook is the same: clear formula stories, accessible shades from light to dark, textures that are hydrating yet weightless, and refills that feel like good design. Build ranges that people are happy wearing, keep the education fun and honest, and let your brands and collection architecture make discovery easy. Do that, and you will earn the routine, the review, and the repeat—product by product, season after season.

Reference Sources