What Percentage of Holiday Shopping Happens Online? 2025 US Retail Insights

19 Nov, 2025

|

10 Min Read

Read Blog

Table of Contents

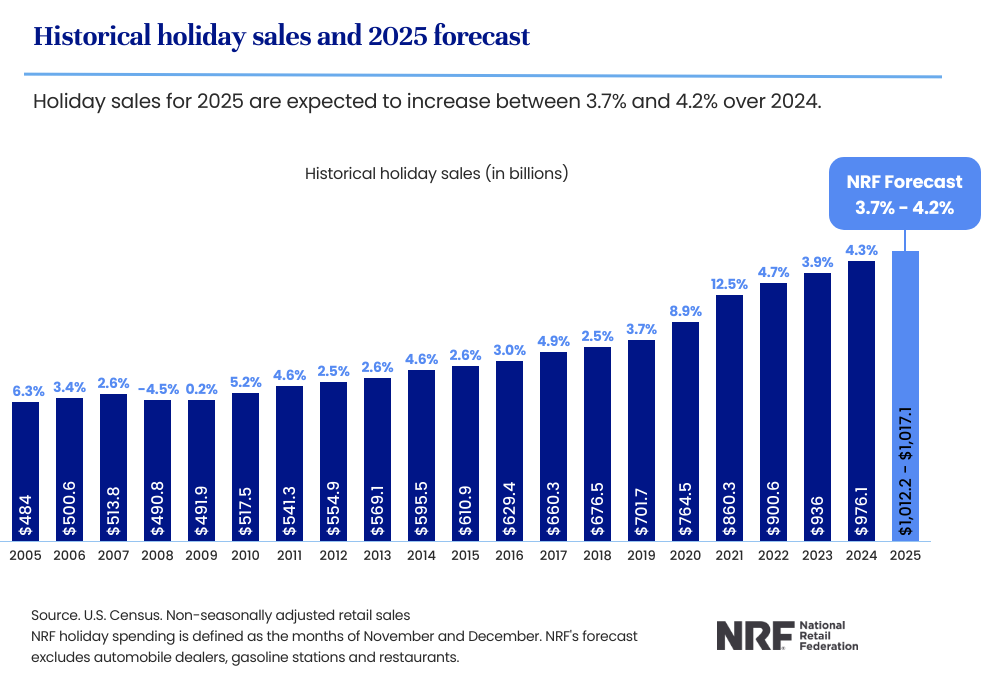

Per‑capita outlay peaked at $901.99 in 2024 and is projected to average $890.49 in 2025 holiday trading. Participation stays broad, consumers planning to celebrate and chase sale events, while digital remains the holiday shopping destination of choice.

Key points

Gifts command the largest share: $627.93 for presents, $262.56 for seasonal items.

55% of plan purchases are digital; stores still matter (grocery: 46%, department: 44%, discount: 42%).

42% will begin browsing before November; many finish in December and pivot around Thanksgiving weekend.

Tariffs and higher prices keep value in focus; shoppers still prioritise loved ones.

Families with kids lift gift budgets by roughly $33 on average.

Hold inventory and offers to match persistent demand, keep the experience simple, and phase promotions to serve both early planners and late buyers, with average spending expectations.

Consolidated data

|

Year |

Average holiday spending (USD) |

Annual change |

|

2013 |

767.00 |

— |

|

2014 |

802.00 |

+4.6% |

|

2015 |

819.00 |

+2.1% |

|

2016 |

796.00 |

−2.8% |

|

2017 |

826.00 |

+3.8% |

|

2018 |

853.00 |

+3.3% |

|

2019 |

886.00 |

+3.9% |

|

2020 |

880.00 |

−0.7% |

|

2021 |

879.00 |

−0.1% |

|

2022 |

833.00 |

−5.2% |

|

2023 |

875.00 |

+5.0% |

|

2024 |

901.99 |

+3.1% |

|

2025 (projection) |

890.49 |

−1.3% vs 2024 |

Average holiday spending per person is a reliable barometer of household priorities in the holiday season. It blends gift budgets, seasonal items, and travel choices into one practical figure that merchants can plan against.

Understanding the 2013–2024 arc and the 2025 holiday projection helps retailers, brands, and marketplaces align inventory, price points, and promotion calendars while translating consumer insights into decisions that protect margins and the customer experience.

Average spend has climbed over the period, with short dips in 2016, 2020–2022, and new highs in 2024. The 2025 holiday projection remains elevated despite economic uncertainty, signaling a resilient intent to buy gifts for loved ones.

Source: National Retail Foundation (NRF)

Analyzing average holiday spending per person reveals the deep economic and behavioral forces that have shaped retail over the past decade. From 2013 ($767) through 2019 ($886), the trend was one of steady, predictable growth. This rise was a clear indicator of robust consumer confidence, sustained income growth, and a stable economic environment in which shoppers felt comfortable dedicating a growing share of their budgets to celebrations and gifts.

The curve, however, saw a significant inflection point between 2020 and 2022. This period marked a distinct softening in average spending, culminating in a drop to $833 in 2022. This decline reflected a perfect storm of pressures: initial pandemic-related economic uncertainty, inflation eroding purchasing power, and consumers pivoting away from discretionary goods.

Following the dip, a strong recovery materialized, pushing spending back up to $875 in 2023 and an even higher $901.99 in 2024. This rebound demonstrates a powerful consumer desire to return to pre-pandemic celebration levels, with households prioritizing holiday spending even amid persistent high prices. Looking ahead, the 2025 outlook shows a modest pullback to $890.49.

This slight softening suggests that while high prices and economic concerns continue to weigh on budgets, consumers are generally planning to maintain their holiday traditions, keeping the average spending near its recent high watermark. This trend line signals resilient demand tempered by heightened budget consciousness.

Holiday gifts remain the anchor of holiday spending. Out of the total, Americans plan to spend $627.93 on holiday gifts for family and friends, with $262.56 on seasonal items. Most holiday shoppers will balance gift spending with food, décor, and greeting cards, keeping overall holiday budgets close to recent peaks. Notably, families with children expect to expand gift budgets by about $33.

Winter holidays are still widely celebrated (91%). Early shopping is routine: nearly two-thirds cite budget smoothing or crowd avoidance among reasons to begin browsing early, and more consumers will chase sale events. At the same time, roughly half expect to finish in December, and many will lean into Thanksgiving weekend to capture deals. This split matters for calendar planning: stagger promotions to catch both planners and last-minute shopping segments.

Digital continues to lead as the top holiday shopping destination. According to the survey, 55% will buy online, 46% will visit grocery stores, 44% will use department stores, and 42% will head to discount stores. This mix underscores the role of omnichannel assortment and pickup options during holiday shopping peaks.

According to the survey, 85% of holiday shoppers anticipate higher prices tied to tariff concerns, reinforcing the appeal of sale events and value messaging. While consumer sentiment varies, Americans prioritize spending on loved ones, and ensure consumers can still find value through smart merchandising and clear offers.

According to the survey, the most desired items are gift cards (50%), clothing and accessories (46%), books and other media (27%), personal care (23%), and electronics (22%). This ranking should inform feature space and bundle design, especially for Christmas gifts and family gifts categories.

Holiday travel affects wallets as much as baskets. Holiday travelers with travel plans will allocate travel expenses alongside retail outlays, shaping when and how they buy. Retailers should monitor airport‑adjacent locations and shipping cutoffs as shoppers planning trips adjust their schedules.

Younger generations sustain digital momentum and begin browsing earlier, making them receptive to event‑driven promos and creator content. Consumers planning to buy across multiple destinations will compare quickly; sharp copy and clear return policies help close holiday purchases without friction.

The dynamic shifts in average holiday spending, coupled with sustained consumer budget sensitivity, demand a highly strategic, meticulously planned retail response. The upcoming holiday season is not just a test of sales volume but of operational efficiency and strategic pricing integrity.

The following section outlines essential execution pillars (from inventory management and promotional phasing to content strategy and omnichannel synchronization) that retailers must implement to successfully navigate the expected average spend of $890.49 and maximize margins during the crucial 2025 holiday shopping window.

Inventory and pricing: Use the average holiday spending per person trendline to size core items, then protect margin with limited‑time holiday special bundles. Keep key SKUs in stock for both early and late waves.

Promotions: Phase sale events from October through Thanksgiving weekend to catch planners and deal‑hunters. Offer simple thresholds that help shoppers save money without confusion.

Content and UX: Make gift pages intuitive for holiday gift shopping and Christmas shopping journeys. Surface best‑sellers and seasonal items with fast filters to help shoppers buy gifts for family members and friends.

Omnichannel: Balance online marketplaces' reach with store‑level readiness. Align pickup cutoffs to ease anxiety for last-minute shopping.

Analytics: Track per-person average in-season spend to validate whether plan-to-spend levels hold, then shift offers accordingly.

The 2025 holiday picture is stable at a high base. People will still buy gifts, keep traditions, and move their dollars toward clarity, convenience, and value. Treat average holiday spending as the ceiling for assortment and the floor for service: make it easy to complete holiday shopping plans, respect budgets, and show why your offer is worth it.

The result is healthier baskets and durable relationships when the season ends.