Ecommerce Average Order Value: 2026 Benchmarks, Data & Key Insights

20 Nov, 2025

|

13 Min Read

Read Blog

Table of Contents

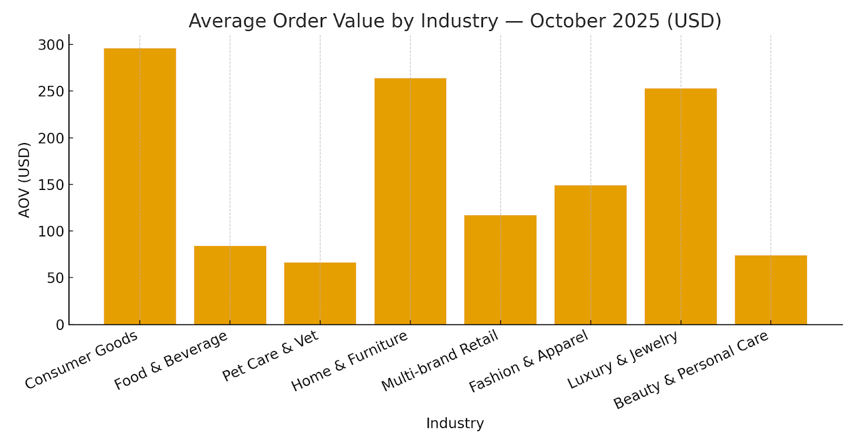

Average order value by industry shows wide spreads across categories, devices, and regions. Consumer Goods, Home & Furniture, and Luxury & Jewelry lead; Food & Beverage and Beauty & Personal Care remain lower by design. Use thresholds, bundles, and segmentation to increase order values without hurting conversion rates.

Key points

Category matters: higher aov in considered purchases; lower in frequent‑buy categories.

Region and device shape baskets: desktop users buy bigger; mobile shoppers buy faster.

Execution levers: tiered discounts, cross-selling, and calibrated thresholds.

Watch volatility: veterinary services and luxury goods moved most in the latest window.

Measure weekly: industry benchmarks plus customer behavior help ecommerce businesses make better calls.

Let the value by industry guide your pricing strategy and merchandising. Start with benchmarks, confirm with your own customer data, and iterate. Over time, small moves compound into healthier order value and more substantial profit margins.

Summarizing the data

This table summarizes key comparative metrics, including the overall context, industry extremes, and AOV based on geographic region and device used.

|

Category |

Metric |

AOV (USD) |

|

Global Context |

Overall Industry Average (Ref) |

~$150 |

|

Industry Leader (Luxury & Jewelry) |

$328 |

|

|

Industry Low (Beauty & Personal Care) |

$67 |

|

|

Region |

Americas (Current) |

$183 |

|

APAC (Current) |

$135 |

|

|

EMEA (Current) |

$128 |

|

|

Device |

Desktop |

$192 |

|

Tablet |

$139 |

|

|

Mobile |

$133 |

This table focuses on the recent monthly trend for specific industries from May 2025 to October 2025.

|

Industry |

Oct '25 (USD) |

Sep '25 (USD) |

Aug '25 (USD) |

6-Month Average (Approx.) |

|

Consumer Goods |

$296 |

$302 |

$306 |

~$269 |

|

Home & Furniture |

$264 |

$275 |

$295 |

~$259 |

|

Fashion & Apparel |

$149 |

$149 |

$160 |

~$153 |

|

Multi‑brand Retail |

$117 |

$118 |

$112 |

~$100 |

|

Food & Beverage |

$84 |

$84 |

$87 |

~$82 |

|

Beauty & Personal Care |

$74 |

$74 |

$75 |

~$69 |

|

Pet Care & Veterinary |

$66 |

$76 |

$75 |

~$65 |

Note: The "6-Month Average" includes the data points from May, June, and July, which show significant variability (e.g., July's low values) that impact the long-term average. The dollar signs have been standardized, and the missing value for Multi-brand Retail (Oct 2025) has been assumed to be $117 based on the provided data sequence.

Average Order Value (AOV) by industry is the lens retailers use to separate category dynamics from noise. It shows how much customers spend per single transaction in different verticals and why the same promotion lifts one market but barely moves another. Today’s figures confirm a significant AOV gap between luxury‑led baskets and value‑driven categories. Moreover, they show meaningful spreads across regions and devices.

Leaders track average order values alongside conversion rate, free shipping thresholds, and pricing strategy because order value by industry guides budgets, merchandising, and profit margins without slowing growth.

A quick refresher helps align teams. Average order value (AOV) is the average dollar amount customers spend per order in a defined period, calculated by dividing total revenue by the number of orders in the same period. A good average order value depends on the business model, price points, and customer segments. Industry benchmarks are a starting point; use them with spending patterns, seasonal trends, and customer behavior to make smarter decisions.

Below are the current aov figures by category, followed by details on what they mean. The following data is sourced from recent Dynamic Yield Insights.

Source: Dynamic Yield

Current AOV: $296 | Previous month: $302

Six‑month path: May is at $361, June at $268, July at $85, August at $306, September at $302, and October at $296.

Order values remain high despite a slight dip from the previous month. Larger purchases are concentrated in replenishment bundles and higher-priced items. Cross-selling complementary products and tiered discounts can increase aov without unnecessary promos. Track desktop users and mobile shoppers to set free shipping thresholds that motivate customers without eroding profit margins.

Current AOV: $84 | Previous month: $84

Six‑month path: May is at $101, June at $97, July at $23, August at $87, September at $84, and October at $84.

Lower-order values reflect frequent baskets and tight price points. Loyalty programs and volume-based discounts encourage customers to stretch baskets a little. In this category, customers spend when convenience and freshness are clear. A small, well‑timed complementary product nudge tends to work better than heavy discounts.

Current AOV: $66 | Previous month: $76

Six‑month path: May is at $76, June at $74, July at $18, August at $75, September at $76, and October at $66.

The category shows a sharp month‑to‑month swing and a clear slight dip into October. Subscription refills, appointment add‑ons, and care bundles help stabilize order values. Customer segmentation by pet type and age improves attach rates on complementary products.

Current AOV: $264 | Previous month: $275

Six‑month path: May is at $291, June at $311, July at $74, August at $295, September at $275, and October at $264.

Ticket sizes are high but cyclical. Multi-brand retail partners in living spaces should use financing messages and delivery clarity to protect conversion rate while increasing aov with room sets and protection plans. Slight discounts timed to seasonal changes often boost total revenue more than broad markdowns.

Current AOV: $117 | Previous month: $118

Six‑month path: May is at $118, June at $119, July at $25, August at $112, September at $118, and October at $117.

Broad catalogs mean wide spending habits. Dynamic pricing and volume discounts for basket mixes help lift average order values. Use customer journey signals with Google Analytics to identify which combinations raise order value by industry cohort.

Current AOV: $149 | Previous month: $149

Six‑month path: May is at $157, June at $162, July at $43, August at $160, September at $149, and October at $149.

Assortment breadth and fit risk limit basket size. Use size assurance and easy returns to protect conversion rate. Cross-selling works best when product pages anchor a look rather than a single item.

Current AOV: $253 | Previous month: $378

Six‑month path: May is at $389, June at $419, July at $104, August at $433, September at $378, and October at $253.

After a strong run, the category shows a pronounced slight dip from September. This is still a higher aov arena, where financing, provenance badges, and private offers matter more than couponing. The jewelry industry benefits from concierge‑like cart support at checkout.

Current AOV: $74 | Previous month: $74

Six‑month path: May is at $76, June at $72, July at $17, August at $75, September at $74, and October at $74.

Frequent, lower‑ticket purchases dominate. Shopify stores should use bundles, refill reminders, and slight discounts as nudges. Mobile shoppers tend to buy quickly; streamline the checkout process.

Region: Americas lead with $183, then APAC $135, EMEA $128.

Device: Desktop: AOV is $192; Tablet: $139; Mobile: $133.

Mobile shoppers tend to convert fast with smaller baskets; desktop users research and commit to larger purchases. Set target aov and free shipping thresholds by region and device. This avoids blunt rules that depress profit margins.

The value by industry view is only useful if it informs execution.

Use cross-selling on product pages that reflect customer behavior by cohort. Recommend a complementary product that aligns with purchase intent rather than generic add‑ons.

Adopt tiered and volume-based discounts in categories where larger purchases do not disproportionately increase shipping costs. Slight discounts should nudge, not train audiences to wait.

Calibrate free shipping thresholds just above the typical average order for each cohort. This increases aov while protecting total revenue and profit margins.

Build customer segmentation that mirrors the customer segments you actually serve: new customers vs. existing customers, high‑frequency vs. considered buyers. Align loyalty programs to lift customer lifetime value, not just one month’s numbers.

Where data shows a sudden move (like veterinary services or luxury goods), use price points, availability, and messages to stabilize baskets. Confirm whether a promotion or a stock shift drove the change in the same period.

Average order value by industry is not a scoreboard. It is a map for execution. Use the spreads you see here to set target aov by cohort, refine cross-selling, and place free shipping thresholds where they move behavior rather than margin.

When teams price with intent, surface the right complementary product, and remove checkout friction, average order values rise for the right reasons—and revenue growth follows without sacrificing customer lifetime value.